For marketplace sellers

For crypto traders

For rideshare drivers

For delivery driver

intelligent tax reporting

Income tax reporting app

10

Professions supported

10

Countries supported

10

Questions to answer

10

minutes to fill out the form

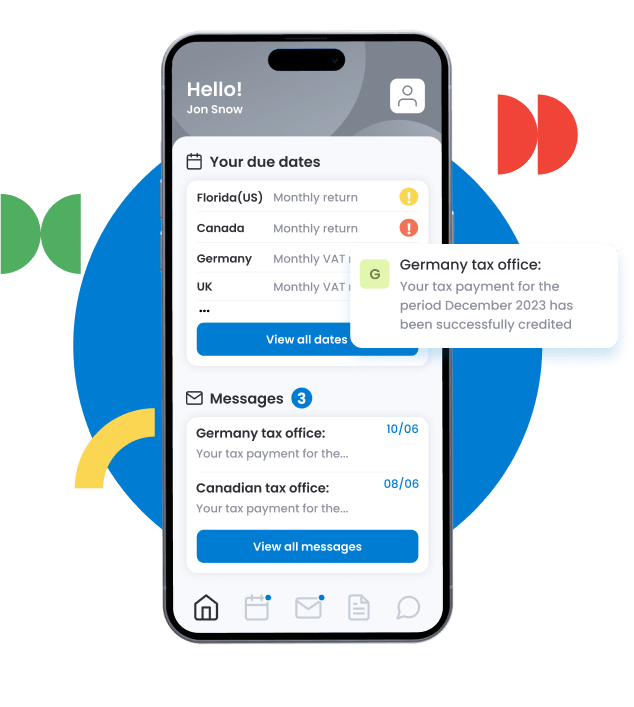

If you received your DAC7 notice from your platform

For service providers the reporting threshold is zero, that means that platform like Upwork will send all your info to tax office even when you provide services occasionally.

Read moretaxi drivers, beauty specialists, designer, blogger, marketplace seller. When you choose your profession, you will get questions related to it and skip non relevant information.

If you have more than one notification than them scan one by one.

Expenses like shipping and supply costs are generally deductible business expenses, so keep track of each item’s cost basis and the final sale price to determine the cost of goods sold.

AI will analyze and pre-qualify these transactions for future income tax return.

Trusted by sellers of biggest platforms

Income tax reporting too for 10 types of business

For online sellers

Etsy seller and Second hand

For creative industry

Bloggers and Designers

For those who on the move

Drivers and Delivery

How it works

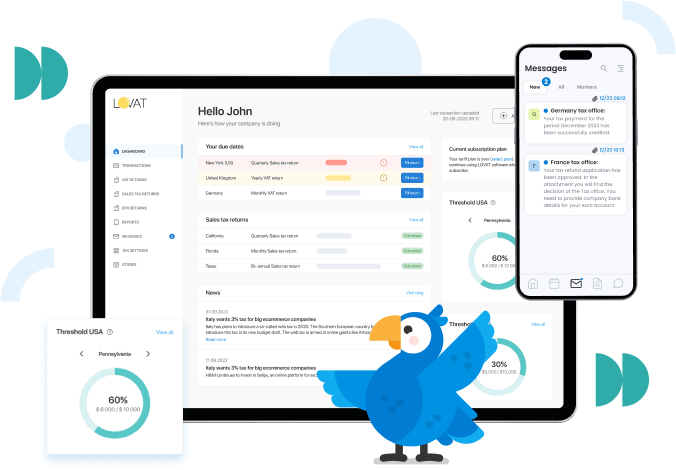

Our friendly support team is here to help

We fundamentally do not use robots and answering machines when answering and assisting clients, only living competent people

Support team help to solve any of your tasks where it is convenient for you: